Florida Health Insurance Marketplace Enrollment Help

★★★★★

★★★★★

Get FREE Enrollment Guidance

Let’s Work Together to Find

Affordable Health Insurance

We can help you find an affordable health insurance plan that fits your budget and healthcare needs.

The new special enrollment period allows for even more people to be eligible for year-round Healthcare Marketplace enrollment.

Assistance is available in English, Español, Kreyol, Português, and more.

A HIPAA compliant referral can be made using the referral tool.

and runs through January 16, 2024.

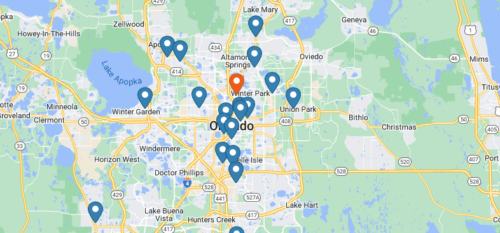

We Cover All of Central Florida

Our team of multilingual Navigators covers a 4-county area, including Lake, Orange, Osceola, and Seminole counties.

- Compare plans

- Renew coverage options

- Switch health insurance providers

- Update account information

- Apply for help with public health programs

- Locate providers

- Understand health insurance terms

- Assistance with EOBs and payments

- Review health plan options

- Understand prescription options

- Answer any questions you may have

- And more

and runs through October 31, 2024.

3 Quick Steps to Finding Affordable Health Insurance Coverage

The Florida Health Insurance Marketplace provides health plan shopping and enrollment services through the healthcare.gov website with many great insurance providers to choose from.

This makes proper coverage attainable for everyone, but can be a daunting process if it’s your first time.

That’s where we come in.

Contact us by phone or online to meet with a Marketplace Navigator.

Meet with the Marketplace Navigator to compare coverage options.

Choose a health plan perfect for you and complete enrollment.

Call now to get assistance signing up for the Health Insurance Marketplace.

Covering Florida Health Insurance Marketplace

Navigating the Health Insurance Marketplace in Florida and selecting coverage that is right for your family can be a confusing process.

Our team of Marketplace Navigators are available free of charge to walk you through the process of determining coverage needs, sorting plans, and all the way to you getting enrolled.

We make the process of getting health insurance easy and painless.

In-Person Assistance Available

Find a nearby Certified Navigator to assist you in finding the health insurance that best matches your needs.

What Our Amazing Clients Say

Discover why client’s love working with the Covering Central Florida team, and why they come back yearly.

★★★★★

★★★★★

CoveringCFL has been my navigator for a couple of years and has been wonderful, going over all of my options and what best suits our family.

Insured Client

Lake County Resident

Nancy is a gem. I’m so thankful that I found her. Dealing with the marketplace alone before I found her was a Nightmare. I recommend her Highly!

Insured Client

Orange County Resident

Doris is very professional and works hard to answer all questions. She avails herself to help. I have learned a lot about the Marketplace since meeting Doris.

Insured Client

Lake County Resident

Working with a navigator was really helpful because I had looked at the website on my own before, but I didn’t know how to do what I needed.

Insured Client

Orange County Resident

We’d love to hear about your experience with us. Read more reviews.

Florida Health Coverage News

Stay updated with the latest developments in Florida’s health insurance marketplace and health coverage and landscape.

Florida KidCare Income Limits and Eligibility

Grasping the eligibility criteria for Florida KidCare can be intricate, especially with the periodic updates in rules and guidelines. The primary emphasis for Florida KidCare

Florida Medicaid Income Limits and Eligibility

Understanding the eligibility criteria for Medicaid can be daunting, especially with the frequent changes in rules and regulations. The primary focus for Florida Medicaid eligibility

Urgent Care vs Emergency Room: Which is Right for You?

Discover the key differences between urgent care and emergency room services to determine which option is best for your medical needs.

Health Insurance vs Life Insurance Florida

Navigating the world of insurance in Florida can be overwhelming.

Highly experienced and knowledgeable staff who can help you get the best coverage you need.

Our team of Marketplace Navigators is certified to help your family find the exact coverage you need.

We're funded through a grant from Health and Human Services, a federal entity.

We’re always here when you need us. We work to get the answers you need to get coverage and stay enrolled.

We work with several community partners throughout Central Florida to provide enrollment assistance.

If you’re a resident of the Sunshine State looking for health insurance, the Florida Health Insurance Marketplace is your go-to resource. This platform offers a variety of plans to suit different needs and budgets, making it easier for Floridians to access affordable healthcare. Whether you’re self-employed, unemployed, or your employer doesn’t provide health insurance, the marketplace is designed to help you find a plan that fits your circumstances. Remember, it’s not just about finding the cheapest option, but the one that offers the coverage you need at a price you can afford.